how to change how much taxes are taken out of paycheck

Peach State residents who make more money. These include your income tax withholdings contributions to work.

Irs New Tax Withholding Tables

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

. How to change how much taxes are taken out of paycheck Friday February 18 2022 Edit To figure out the yearly amount take the new amount withheld per pay period and. To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods. 2 Their estimated tax amount can be used as part of your form adjusting your withholding accordingly.

Use our W-4 calculator and see how to fill out a 2022 Form W-4 to change withholdings. Overview Of Georgia Taxes. If you prefer owing the IRS at years end rather than receiving a refund you may need to complete a new W-4 form to change the tax that your employer withholds from your.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. Get a new W-4 Form and fill it out completely based on your situation. The dollar amount of your paycheck depends on your wages or salary minus your payroll adjustments.

Submit your new W-4 to. Helping business owners for over 15 years. For the first 20 pay periods therefore the total FICA tax withholding is equal to or.

Form W-4 tells your employer how much tax to withhold from your paycheck. This is a rough estimate of what your. 3 If you are receiving pension payments you may need to provide the.

Its important to note that there are limits to the pre-tax contribution amounts. Ask your employer if they use an automated. Figure out your new withholding on through the IRSs tax withholding estimator.

To fatten your paycheck and receive a smaller refund submit a new Form W-4 to your employer that more accurately reflects your tax situation and decreases your federal. For those age 50 or older the limit is 27000. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their.

The UK employee pays 0 of income tax on income up to 11850 12500 for 2019-20 and 20 for anything over 11851. Only the very last 1475 you earned. Your employer is required to have you fill out a W-4 form when you start work in order to determine the amount of estimated income tax to withhold from your paycheck.

To change your tax withholding amount. For a single filer the first 9875 you earn is taxed at 10. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. In order to adjust your tax withholding you will have to complete a new W-4 form with your employer. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. For 2022 the limit for 401 k plans is 20500. You can ask your employer for a copy of this form or you can obtain it.

Does Amazon Take Taxes Out Of A Paycheck Quora

2021 2022 Income Tax Calculator Canada Wowa Ca

Check Your Paycheck News Congressman Daniel Webster

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

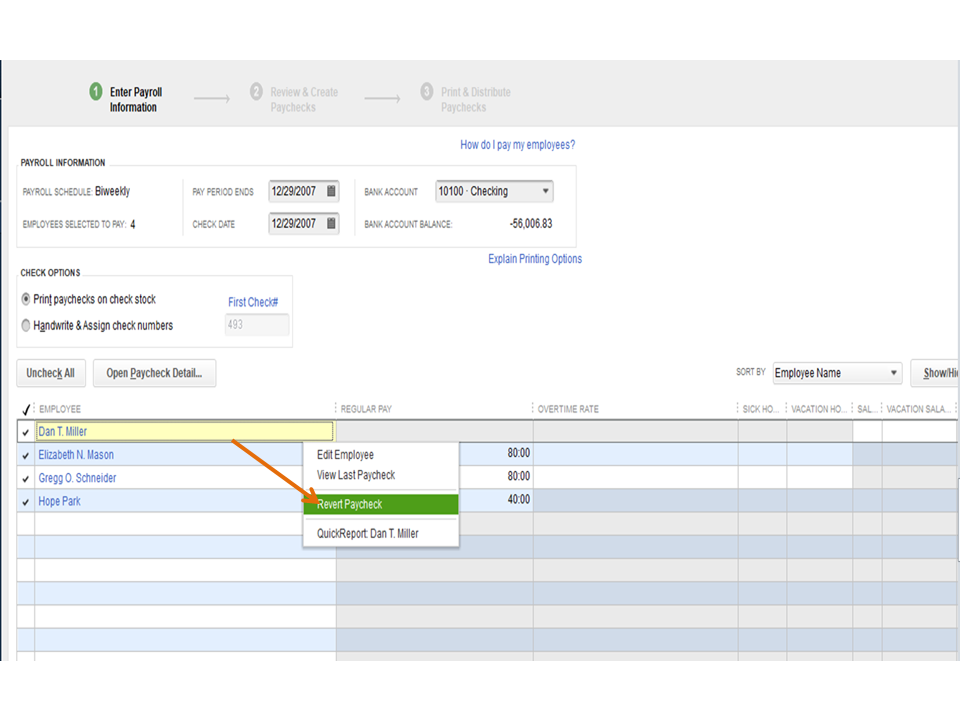

Solved Payroll Taxes Not Deducted Correctly

Paycheck Calculator Online For Per Pay Period Create W 4

Solved Federal Taxes Not Deducted Correctly

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

How To Calculate Payroll Tax Deductions Monster Ca

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Pay Stub Meaning What It Is And What To Include On A Pay Stub

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Decoding Your Paystub In 2022 Entertainment Partners

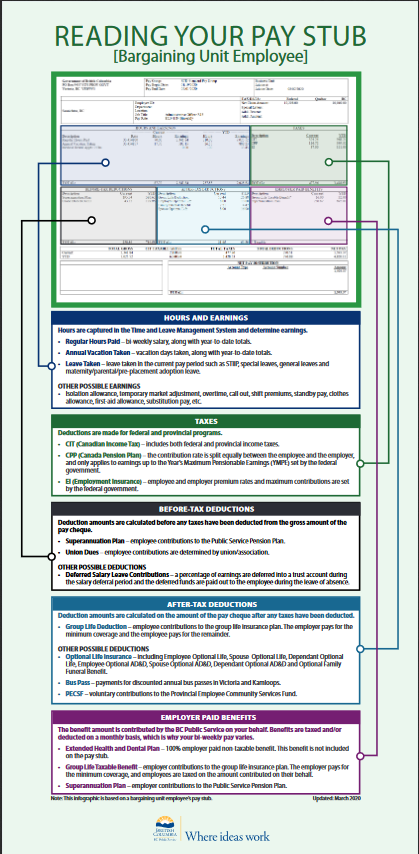

How To Read Your Pay Stub Province Of British Columbia

Different Types Of Payroll Deductions Gusto

How To Calculate Taxes Using A Paycheck Stub The Motley Fool